Why Now Is the Time for Charitable Stock Gifting

This blog was written in collaboration with Steve Latham, CEO and co-founder of DonateStock.

Philanthropy is at an inflection point.

Twenty years ago, almost two-thirds of U.S. households gave to charities, churches, schools, and foundations. That number is now less than 50%. There are also 20% fewer donors this decade than last, and retention in all categories has dropped.¹

Rather than surrender to fundraising headwinds—namely fewer donors and persistent inflation—let’s zero in on the power of noncash giving and examine exactly how it has kept nonprofit organizations like yours afloat during financial uncertainty.

How We Got Here

Before we can build a life raft, it’s crucial to know how we got here.

After record levels of charitable giving in 2020 and 2021, fueled by stimulus spending and a surging stock market, circumstances changed.

In 2022, the stock market fell almost 20%, making it the worst year since 2008. At the same time, record inflation emerged, and many households began tightening their belts.

Consequently, we saw the first material decrease in charitable giving since 2010—down $20 billion year over year or 13% when adjusted for inflation. The decline would have been greater, but the collective $25 billion in donations in 2022 from mega-donors like MacKenzie Scott, Bill Gates, Jeff Bezos, and Mike Bloomberg helped cushion the impact.

Dealing with higher costs and, in many cases, lower revenue, nonprofit executives found it increasingly difficult to execute their missions.

Sizing Up the 2023 Year-End Season

The outlook is concerning as we navigate the year-end giving season for 2023. While we won’t know the results until likely spring 2024, nonprofits anticipate that persistent inflation, higher living costs, and record-level consumer debt will challenge overall donation volume.

For these reasons, most fundraisers expect flat or negative results for 2023 compared to 2022.

Despite dim forecasts, there are things nonprofits can do and data that shows how technology can help establish new giving on-ramps. Soraya Alexander, President of Classy and COO of GoFundMe, said it best in her recent article for The Chronicle of Philanthropy.

The foundation of nonprofit fundraising remains the same—engaging donors in meaningful ways to unlock their generosity for your cause. However, what constitutes a meaningful connection does change, so fundraising strategies must evolve to stay relevant. The most powerful fortification for a nonprofit is the willingness and capacity to adapt.

Cash Isn’t Always King

While the outlook is challenging for organizations relying exclusively on cash and credit, forward-leaning fundraisers look beyond cash and credit to diversify and grow their funding sources.

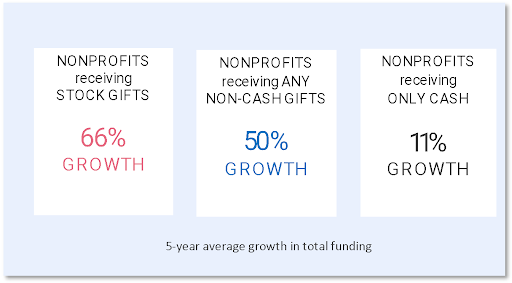

As Russell James’ research proved, cash is not always king when it comes to charitable giving.² The table below shows how nonprofits that solicit cash and noncash gifts have seen more success in growing revenue. In short, organizations that receive stock along with cash grew 6x faster than those that relied solely on cash and credit cards.

Organizations that provide donors with flexible giving options are much better positioned than those limiting supporters’ contribution methods.

For example, allowing donors to make tax-advantaged gifts of stock yields substantial benefits for all parties. We dive more into this below.

Noncash Assets of Choice

When it comes to noncash giving, nonprofits must meet their donors where they are and make it easy for them to donate via donor-advised funds (DAFs), qualified charitable distributions, cryptocurrency, and stock. While all represent incremental funding sources, stocks are the largest and most widely held financial asset.

In 2023, more than half of U.S. households own $30 trillion in stocks, mutual funds, and related investments.³ Conservatively speaking, this means stock gifting should be worth $50-$75 billion in incremental annual funding.

Unfortunately, stock gifting is still not largely utilized outside the top 1%. While there’s very little data surrounding stock gifting, we estimate the actual amount—exclusive of DAF contributions and gifts by the previously mentioned mega-donors—is less than $5 billion annually.

It’s also worth noting that while most households feel short on cash, many are long on stock. The S&P 500 is less than 10% from its all-time high, and the most widely held stocks—Alphabet, Apple, Nvidia, Microsoft, Meta, Amazon, and Tesla—are all up 300%-1,000% over the past five years.

With investors sitting on trillions in gains, that could (and should) flow to nonprofits. Unfortunately, stock gifting has been largely untapped to date.

Why Stock Gifting?

Charitable stock gifting offers compelling advantages for donors and nonprofits alike.

Donors benefit by avoiding capital gains tax while deducting the current market value of gifted stock held more than one year. As illustrated below, the tax savings can be significant:

- If you invested $2,000 in Apple stock five years ago, it would be worth more than $10,000 today. However, if you wanted to sell the stock and share your gains with a charity, you’d pay tax on the $8,000 capital gain, which would likely total about $2,000, depending on your income and location. The charity would receive the $8,000 after-tax proceeds—the same amount you could deduct.

- If, instead of selling the stock, you donated it, you wouldn’t deduct or owe tax. The charity would receive the full $10,000 (25% more), and you would deduct $10,000 (20% larger deduction).

In short, nonprofits benefit from the larger gifts, while donors benefit from the larger tax deductions. Everyone wins.

The Stock Gifting Gap

Despite its numerous benefits, stock gifting has been massively underutilized by donors and nonprofits. Even though most major and midlevel donors have investment accounts, stock gifts typically comprise less than 2% of the total proceeds among nonprofits.

Several factors often contribute to this shortfall in giving capacity:

- Awareness: Few investors and tax professionals are aware of the benefits of stock gifting. While most know donors can deduct their stock gifts, few understand they can avoid long-term capital gains tax, increasing their tax deductions and potentially qualifying them for a lower tax bracket.

- Donor experience: The donor experience can be painstaking, often taking hours to research the process, gather information, submit paperwork, and wait to hear back. It’s also a time-consuming process for financial advisors who make gifts on behalf of clients. Friction is a major deterrent.

- Access: Few nonprofits have a brokerage account, which is necessary to receive stock. For compliance and economic reasons, retail brokerages cannot serve small nonprofits. Consequently, this excludes most of the 1.6 million tax-exempt organizations.

- Operational friction: The process of selling, reconciling, and acknowledging stock gifts can be manually intensive, often involving several people and consuming 3-4 hours per stock gift.

- Lack of donor information: To the dismay of development and advancement offices, donors’ information doesn’t accompany their stock gifts. Unless the donor shares their gift details with the nonprofit, it won’t know who to acknowledge.

- Similar stock gifts: Donors tend to gift the same widely held, outperforming stocks, such as Apple, Microsoft, Tesla, and Nvidia, representing 25% of all gifts we’ve processed at DonateStock. When you receive multiple gifts of the same stock, it’s hard to know whose stock is whose.

- Visibility: Due to the numerous challenges nonprofits have in processing stock gifts that often strain donor relations, many organizations are reluctant to promote stock gifting to donors, nudging them to make smaller, after-tax gifts via credit card and ACH payment.

Acknowledging the barriers, technologists knew there had to be an easier way. Now, with a leveled playing field, donors can easily gift stock with seamless solutions, such as those offered by DonateStock.

Democratizing Stock Gifting

With advances in technology and innovation come new solutions. What excites us the most is that today’s tools have removed the barriers outlined above, making stock gifting accessible for all donors and nonprofits.

Here’s a summary of how we’ve democratized stock gifting for all parties at DonateStock.

- Modern donor experience: What used to take hours now takes minutes through our Easy Button for Stock Gifting. Through a PayPal-like experience, donors can initiate stock gifts with ease at no cost. Email notifications and dashboard reporting are also available, granting donors greater transparency with the status, details, and acknowledgment of each gift. By making stock gifting an enjoyable process, donors are more inclined to make subsequent donations.

- Access for all nonprofits: Organizations of all sizes can now receive stock gifts—no brokerage account required. DonateStock Charitable Inc.—a 501(c)(3) organization—can receive and process gifts for nonprofits that don’t have (or prefer not to manage) a brokerage account.

- Transparency: Nonprofits now have full visibility into the donor information, value, and status of each stock gift. With dashboard reporting and notifications, gift reconciliations and donor stewardship are easier than ever.

Capacity Scaling

Another large benefit of modern stock gifting solutions is scalability. By automating manual processes, nonprofit organizations of all sizes can do more with less and process stock gifts at scale.

Beyond the time saved educating donors, sending instructions, requesting details about each gift, and trying to guess whose stock is whose, they can leverage DonateStock to bypass these manual processes altogether. For those seeking even greater efficiency, they can also outsource the process of reconciling and acknowledging gifts.

Stock Gifting in Action

In 2021, Classy customer World Central Kitchen sought to grow its stock gifting program to fund its mission of providing relief to victims of disasters and conflicts through its global network of volunteers.

After implementing DonateStock’s easy button on its main website, WCK’s stock gifting grew by 1,500% in 2022, with proceeds increasing from 1.3% to almost 9%.

WCK also saw tremendous gains in efficiency. By outsourcing the back-end process of selling, reconciling, and acknowledging gifts on its behalf, WCK could scale stock gifting without hiring additional staff.

To learn more about how WCK achieved such incredible success, explore the full case study.

Why Now Is the Time for Stock Gifting

While cash giving faces numerous headwinds, billions in stock gifts are available for the taking.

Now that tax-advantaged stock gifting is easy, accessible, manageable, and scalable for all nonprofits, it can fill the gaps in development and advancement budgets. Plus, early adopters of stock gifting stand to gain the biggest share of stock gifts this year.

In partnership with the Classy fundraising platform, DonateStock is here to help nonprofits lean into stock gifting and do our part to ensure that organizations of all sizes continue to stand tall and strong in these uncertain economic times.

Copy Editor: Ayanna Julien

Article Sources:

1. “Quarterly Fundraising Report,” Fundraising Effectiveness Project, accessed November 13, 2023, https://data.givingtuesday.org/fep-report/.

2. “Cash Is Not King in Fundraising: Results from 1 Million Nonprofit Tax Returns,” accessed November 13, 2023, https://www.pgcalc.com/pdf/ExecutiveSummary.pdf.

3. “What Percentage of Americans Own Stock?” Gallup, last modified May 24, 2023, https://news.gallup.com/poll/266807/percentage-americans-owns-stock.aspx.

Decoding Donation Fluctuations: Turning Data into Action