A Closer Look: Nonprofit vs. Not-for-Profit Models

Request a Demo

Learn how top nonprofits use Classy to power their fundraising.

Although used interchangeably, the terms nonprofit organization and not-for-profit organization are not synonymous.

Nonprofits and not-for-profit organizations share several similarities but have a few key differences in charitable purpose, operations, and tax status.

Understanding what makes nonprofits unique from not-for-profit organizations is crucial, whether partnering with one, making a donation to one, or starting one. Allow this blog to serve as your guide to differentiating between the two and understanding which type of organization aligns with your needs and goals.

What Is a Nonprofit Organization?

All nonprofit organizations (NPOs) serve the public good with a core mission. The money raised from donations must be put toward serving this charitable purpose.

To be a tax-exempt nonprofit, your organization must meet a wide range of requirements by the Internal Revenue Service (IRS). You must also disclose your financial and operational information to the public. This high nonprofit transparency ensures it serves the public good.

Some prominent examples of these charitable organizations include:

- Concern Worldwide US

- Feeding San Diego

- Shriners Hospitals for Children

- Direct Relief

- Denver Rescue Mission

What Is a Not-for-Profit Organization?

Like a nonprofit, not-for-profit organizations (NFPOs) do not distribute a profit to owners. All money earned from fundraising activities or services must go directly back into running the organization.

However, the biggest difference is that not-for-profit organizations do not have to operate for the public benefit. Instead, these serve the goals and objectives of the organization’s members. For this reason, these organizations have fewer requirements, especially with tax-exempt status and operational transparency.

Common examples of not-for-profit organizations include:

- Credit unions

- Trade associations

- Professional organizations

- Sports clubs

- Social clubs

- University alumni associations

5 Major Differences Between Nonprofits and Not-for-Profit Organizations

The factors that distinguish a nonprofit from a not-for-profit organization are subtle but change how each organization functions. Comparisons of nonprofits with not-for-profit organizations fall into these five general categories.

1. Organizational Purpose

A nonprofit must serve the public good and prove how it supports social causes. By contrast, not-for-profit organizations can serve the special interests of members and the organization itself.

2. Tax Status

For IRS tax purposes, there are 26 different types of nonprofit organizations. Most traditional nonprofits fall into the 501(c)(3) category and have to meet certain criteria to fit into that tax-exempt status.

Although NFPOs can fall into a few IRS categories, most are 501(c)(7) organizations, including social causes or recreational clubs.

The primary distinction here is that nonprofit donations are tax deductible for donors, but nonprofits have a higher level of tax scrutiny. Most not-for-profit donors can’t write off their donations as tax deductions without some added steps.

3. Legal Liability

Nonprofit organizations can exist as a separate legal and business entity from the business owner, like a traditional for-profit corporation.

However, not-for-profits are more like a general partnership, where the members cannot separate themselves legally from the organization. There are some exceptions to this rule, but it requires more work from the organization’s leadership.

4. Operational Structure

To serve the public good, most nonprofit organizations rely on paid staff. Their work is supplemented by a team of loyal volunteers and held accountable by an external nonprofit board with volunteer board members.

On the other hand, not-for-profit organizations are typically solely reliant on volunteers and don’t often have a board of directors. If a not-for-profit employed someone full-time, they would be subject to federal and state income tax.

5. Transparency

To retain tax-exempt status, nonprofit charitable organizations must make financial and operational records publicly available. This impacts nonprofit accounting practices and nonprofit financial audit processes.

Not-for-profits don’t have the same financial regulations and operate much more like privately owned for-profit businesses in this way. It’s still a good idea for them to share these reports with members, even if it’s not a requirement.

How Are Nonprofits and Not-for-Profit Organizations Similar?

It’s easy to understand why the general public views nonprofits and not-for-profit organizations interchangeably. Despite the differences, both are unique compared to for-profit companies and function in similar capacities.

The most notable similarity between nonprofits and not-for-profit organizations stems from how both handle money. In both cases, these community organizations funnel profits back into funding the organization rather than distributing any revenue to owners or shareholders.

Additionally, both acquire profits generally the same way, including general donations, fundraising events, corporate sponsorships, or paid services derived from members of the community.

Understanding the Difference to Inform Your Fundraising Strategy

Both nonprofits and not-for-profit organizations are valuable organizations within communities but have different charitable purposes and, therefore, operate differently from one another to accomplish their goals. It’s crucial to understand these differences when starting a charitable organization or partnering with one.

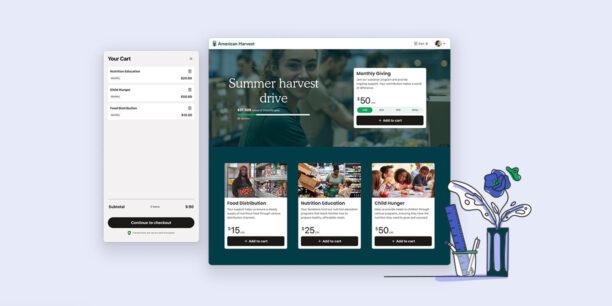

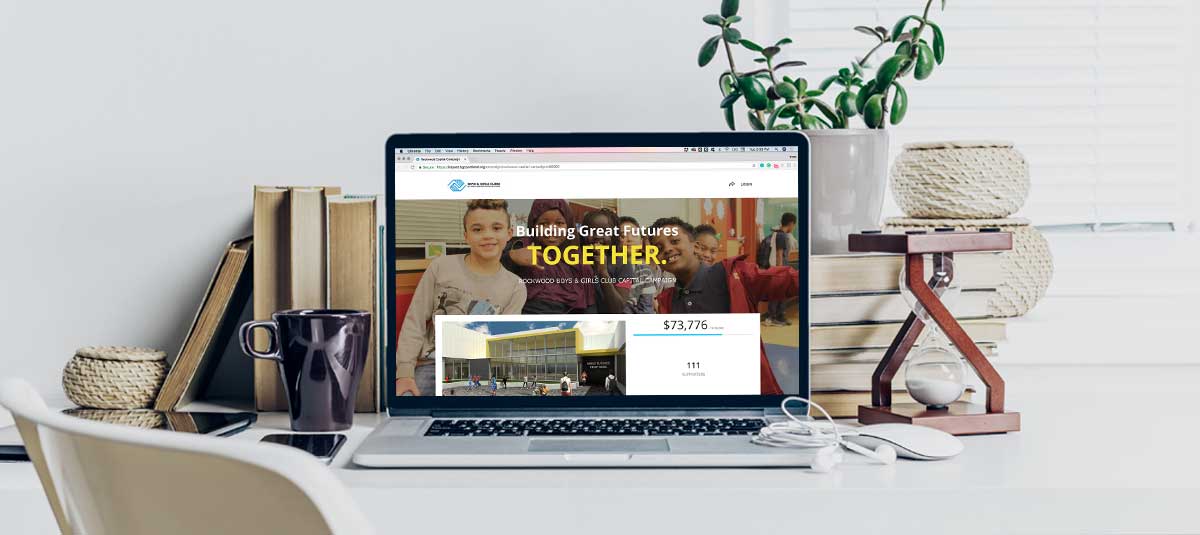

If you’re launching a nonprofit, explore Classy’s How to Start a Nonprofit in 9 Steps and discover how Classy’s comprehensive fundraising suite can help provide a world-class giving experience for every person who lands on your donation site.

Schedule time to chat with a highly trained member of our team today.

Copy Editor: Ayanna Julien

Raise More for Your Nonprofit With Classy

Subscribe to the Classy Blog

Get the latest fundraising tips, trends, and ideas in your inbox.

Thank you for subscribing

You signed up for emails from Classy

Request a Demo

Learn how top nonprofits use Classy to power their fundraising.

Explore Classy.org

Explore Classy.org